Australia’s defined contribution retirement system attempts to provide for the retirement needs of most Australians. The system is further supported by the Aged Pension for those who fall short of retirement income. We look at the genesis of the defined contribution scheme, its benefits and characteristics, followed by a sustainability and affordability analysis. Finally, we provide a few recommendations of our own.

Moving the risk of retirement from the defined benefit model to a defined contribution model transfers the risk from the employer to the employee. This eliminates the risk that the employer could go broke after the individual retires, jeopardizing their retirement.

The current taxation framework for superannuation rests on a 15% flat tax rate for concessional contributions, and earnings during the accumulation phase, and no tax during the retirement phase[1]. This does allow for accelerated savings for retirement for the larger section of society where the propensity/capacity to save is low and alleviates the pressure on government coffers in the future.

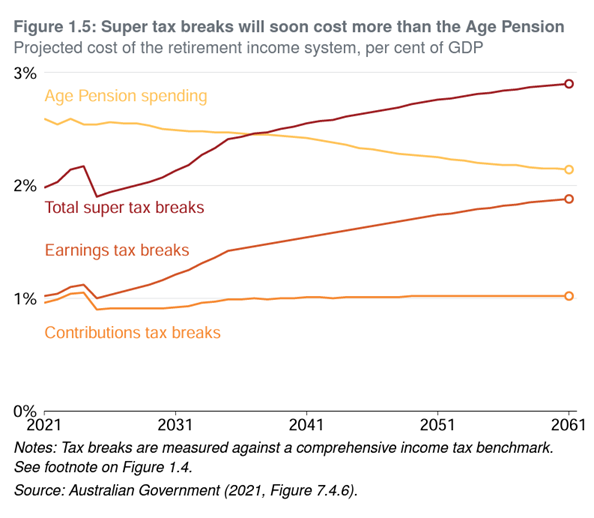

Chart: Coates, B. and Moloney, J. (2023). Super Savings: Practical policies for fairer superannuation and stronger budget. Grattan Institute. https://grattan.edu.au/report/super-savings-practical-policies-for-fairer-superannuation-and-a-stronger-budget/ pg. 14

The issue of sustainability and affordability has to be viewed through the lens of policy trade-offs. If government coffers continue to support the super system at the current rate (please see graph above), super tax breaks will approach almost 3% of GDP by 2061 according to Grattan, with earnings tax breaks being the main driver of that increase. 66% of that benefit flows to the top 20% quintile of the population[2]. If that continues, spending will have to be reduced, taxation will increase, or the government debt will increase. This represents a generational wealth transfer from the young to the old.

Tax breaks offered encourage high-income earners to funnel extra disposable income into super as a tax-effective strategy. The benefit to the middle-income band in Australia is unchanged as the tax benefits of super negate the smaller Age Pension benefit. The benefit to the lower income band is the worst off among the three as they do not take full advantage of the tax concessions offered by super and suffer the smaller Age Pension benefit when in retirement. The unchecked tax advantages super offers are exploited by the high-income cohort and paid for by the low-income cohort in society, a wealth transfer from the rich to the poor[3].

The issue of unaffordability is due to the regressive nature of the super taxation model. This can be avoided by implementing a progressive super tax system such as the income tax model, where the top quintile of the population bears the majority of the burden. Currently, the top 20% quintile of the population bears 62.2% of the income tax burden[4].

A regime that mirrored the income tax brackets but for super earnings with their respective tax brackets (see below as an example) would be a far more superior and equitable model. This would move in line with the tax brackets, and it would allow smaller super earnings to grow at a lower tax rate while taxing higher super earnings at a higher tax rate, moving it towards a more progressive regime. The top rate would be in line with the 25% lower company tax rate, to avoid taxation arbitrage. This would alleviate the government’s problem of the growing tax breaks in superannuation whilst increasing equity in the system.

| Super Income Marginal Tax Rate Tax Payable ($) | Tax Rate | Tax Payable |

| $0 to $18,200 | 0% | 0 |

| $18,201 to $45,000 | 10% | 10% on excess over 18,200 |

| $45,001 to $120,000 | 15% | $2,680 + 15% on excess over 45,000 |

| $120,001 to $180,000 | 20% | $13,930 + 20% on excess over 120,000 |

| Over $180,000 | 25% | $25,930 + 25% on excess over 180,000 |

[1] There are some taxes when retiring between the preservation age and 60 years of age.

[2] Coates, B. and Moloney, J. (2023). Super Savings: Practical policies for fairer superannuation and stronger budget. Grattan Institute. https://grattan.edu.au/report/super-savings-practical-policies-for-fairer-superannuation-and-a-stronger-budget/

[3] Coates, B. and Nolan, J. (2020). Balancing act: managing the trade-offs in retirement incomes policy (Submission to the Retirement Income Review). Grattan Institute. https://grattan.edu.au/wp-content/uploads/2020/03/Grattan-Institutesub-balancing-act-retirement-income-review.pdf.

[4] McIlroy, Read (2023) ‘Top earner shoulder more of the tax burden’, Australian Financial Review, https://www.afr.com/politics/federal/top-earners-shoulder-more-of-the-tax-burden-20230608-p5df2g