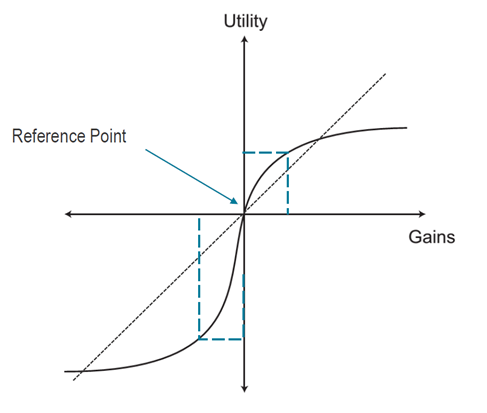

Prospect theory[1], developed by Kahneman and Tversky, observed the asymmetric value felt by individuals in losses over gains as seen in figure below. This contradicts the premise that individuals are utility-maximising agents, which if true, the value function would be a linear 45° line.

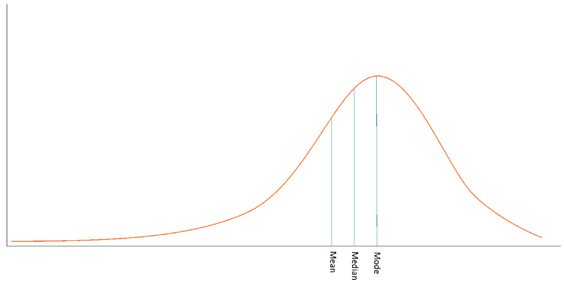

This is best seen in the distribution function of stock market returns as seen below in the figure below, which has kurtosis and a fatter left tail. If humans were profit-maximizing agents, the distribution would be more normal, however as individuals feel loss twice as powerfully as they feel gains, the losses are magnified by panic selling when the markets are falling.

[1] Kahneman, D. and Tversky, A. (1979) ‘Prospect Theory: An Analysis of Decision under Risk’, Econom etrica, 47(2), pp. 263–291. doi:10.2307/1914185.